Seattle Real Estate Video Marketing Builds Trust.

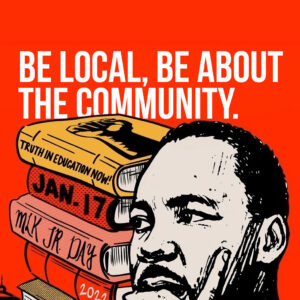

MLK weekend in Seattle is a reminder that trust is built through service and clear answers. That same approach wins in today’s market. With inventory

The Latest and Greatest Marketing News, Comics, and Videos from the Tomato Patch.

MLK weekend in Seattle is a reminder that trust is built through service and clear answers. That same approach wins in today’s market. With inventory

San Diego listing strategy in 2026 works like marathon pacing. Investor headlines can spike hope, but payments still decide demand. Use price-per-payment, tight comps and

Dallas listings need a pacing plan, not louder marketing. Use three price lanes like training zones, share one market stat, and film a 60-second “Buyer

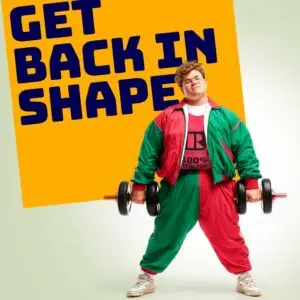

Seattle home values softened across many properties, yet the headline drop stayed modest. This guide uses a yoga and gym class theme to help you

Rates near 6% form a new baseline. Use a weekly script, a dated stat, and a structured Rate Tracker to move frozen buyers. Publish now,

California agents can calm rate noise, use SB 79 to lead near stations, and cut back-and-forth in escrow with one repeatable loop that publishes three

Texas price cuts and buyer leverage are back, which rewards agents who publish calm, weekly explainers with rate context and local data. Use Hot Take

Rates hover near 6.26% while inventory creeps up and buyers cancel more deals. A single nationwide housing playbook turns that noise into clear payment talk

Buyers stall when noise beats narrative. Use buyer anxiety scripts built on current Florida insurance facts, California zoning rules, and Texas inventory trends. Anchor payment

Clients feel whiplash in Miami, LA, and Austin. This week’s coastal market alerts show how rates, insurance, policy, and inventory changed, then give you two